Blog: How can AI automation help financial management become more strategic?

You have probably heard the argument that technology will transform financial administration from a manual processor into a strategic partner for business. This will mostly happen through the freed up time finance admins will have after technology will automatically handle the work they have done by hand.

There are two sides to the argument. Firstly, technology really does free up time from manual work. So obviously the work that financial admins will do in the future with this extra time is one side of the picture. The other side of the picture is what technology will give to the finance units that will help them become strategic partners for business.

Before we dig deeper into the role of AI and its implications for finance work, let’s look at how the financial administration work transforms due to AI technologies.

From process to strategy

Hopefully nobody believes anymore that technology takes away jobs from financial administrators. We’re tired of beating that dead horse. But it does transform the work.

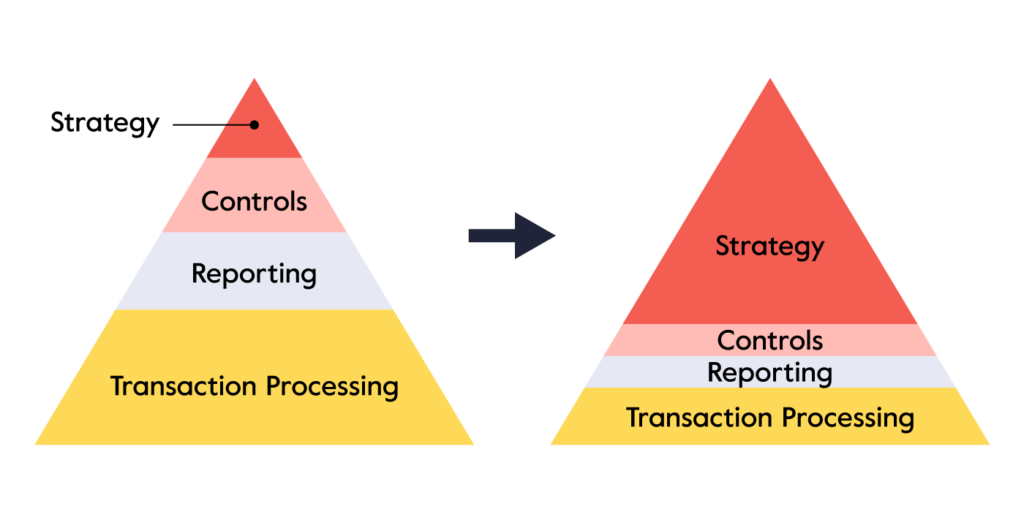

Here we have attempted to visualize where finance units spend their time now and how it should look in the future. As you can see, the work mostly consists of transactional work at the moment. But that work will decrease with AI automation. It will even affect reporting and controls to some extent. It will do some of that work on behalf of people.

The time that is freed up from those areas moves to strategic work. That is where human input can have the greatest effect for business. The work becomes more analytical and – in part – creative.

What this change means is that the work is still there. Businesses will still need people who can provide insight and make predictions based on data, make reports to support decision making, maintain transparency, and look after ethical corporate conduct among other things. These responsibilities will be in the job description of strategic finance professionals.

Technology has a role in all of those areas depicted in the pyramid. But it will be especially important in the strategy space. Technology will supply the data and analytics needed in strategic work and in transforming the finance professional to the role of a strategic partner for the business. Supporting strategic decision making is where the future role of the finance departments is.

Ok, so how does AI exactly help with this, other than freeing up time from finance experts? That’s what we will look at next.

AI increases the amount of data for the benefit of business

The more you automate the more data you will have. AI not only automates, but integrates and processes data in ways that might not even be possible for humans.

That is because AI can collect data from other parts of the company as well: customers, suppliers, human resource, sales, marketing etc. AI can capture the masses of data more accurately, quickly and efficiently. What finance will then do is to use the data from all of those departments for insights, advice on decision-making and to make predictions. Financial administration can use time and data to understand business and help business with their work.

In short: increased AI tools lead finance people to business understanding.

From understanding to reporting

From a strategic standpoint data understanding is one thing, but using it in reporting is golden.

In the future it is not nearly enough that a business report comes 1-2 weeks after the month-end accounting. Either it has to be done within days or, even better, be real time.

In fact, we will see a time when finance departments don’t have to prepare periodic accounts, e.g. month-end, quarter-end, etc. AI technology will make it possible to see accurate financials at any point and time because figures and reporting can be automated.

Before full reporting automation is available, finance people might first have to make the reports more visual and simple so that the main message and insight is easily and quickly understandable to business and management. But once the automated reporting dashboards are in use, traditional reporting gives way to a more insightful real time view on organizational performance.

From insight to foresight

At the moment reporting predominantly looks in the rear mirror. But AI can actually predict future financial results based on trends and market data.

According to Gartner, AI can give companies accurate predictions about finances and even make recommendations about best courses of actions based on those predictions. This will remove human bias from reporting as the models humans create can always be “tweaked” to show what is favorable or expected.

So in what areas can AI technologies be predictive? For example: cash-flow forecasting, revenue forecasting, cost and expense planning, and balance-sheet planning.

Obviously your benefits will depend on the type of company you are. If you are very product centric with a wide range of products, revenue forecasting is where you’ll reap the most benefits from AI. On the other hand, if you’re a multinational corporation competing in a low-margin industry, you probably want to use AI to forecast cash-flow.

AI and other technologies expand the volume and depth of your company’s data and when you as a finance leader look at the data strategically, you have the opportunity to start adding value as a finance department.

AI solutions improve company culture

Now here’s something you probably didn’t expect to hear. A 2021 survey conducted by MIT Sloan Management Review and Boston Consulting Group showed that AI implementation also has cultural benefits.

They had interviewed 2,197 managers and 18 executives about artificial intelligence and business strategy. The report showed that:

- 58% thought that AI solutions improved efficiency and decision-making among teams.

- 78% reported improved collaboration within teams.

- < 75% saw improvements in team morale, collaboration, and collective learning.

Companies that don’t only focus on cutting costs but use AI to explore new ways of creating value, saw better strategic benefits to those companies that only used AI for cost cutting.

Those companies that used AI to create new value were 2.5 times more likely to feel that AI is helping their company competitively compared with those that said they are using AI primarily to improve existing processes.

Respondents who had seen AI solutions bringing financial benefits, were 10 times more likely to change how they measure success.

AI helped leaders identify new performance drivers, which led to new objectives, measures, and patterns of behaviour.

These results demonstrate 2 things:

- When a company has AI systems in place, it changes how people work. Teams perform and collaborate better.

- AI is not merely a technology for reducing costs or increasing revenue. It changes companies’ strategies.

So far we have looked at what technology will give to the finance units that will help them become strategic partners for business. Let’s now turn to looking at what the finance admin should do with all that freed up time.

Changing roles and work of financial administration

AI technologies will free up finance experts time to focus on more strategic work. What is that work? What should the time be spent on?

Think & plan and discuss

Before you start assigning new roles to your people, you need to think and plan. What do you and management think the finance’s time should be spent on? Where do you want to be as a company and how can finance help with that?

Also, we have noticed that many of the finance departments we talk to in different companies, don’t know how much time they spend on all of their processes. They have not set goals and metrics to follow their work. So if this is the case for you, that’s where you should start. Calculate how much time you spend on your processes and how much it costs you, set goals and determine metrics to follow how you do.

Ask your financial experts what it is that interests them. What areas do they want to learn and develop? If they are aligned with your company goals, allow them to pursue those skills and interests.

Potential focus areas

No matter how unique you think your business and company is, there are some focus areas that every company should turn their attention to when work transforms from manual to strategic work. The only thing that varies is which of them is more important to your company’s strategy.

Here’s a few examples of potential focus areas:

- Increase the level of automation in finance and across the company.

- Bring finance and business closer together and find the areas where finance can support business the most effective way possible.

- Develop reporting: what is useful for company and business, how to visualize and simplify reporting, report on profitable acquisitions, create foresight reporting… The opportunities are endless.

- Improve customer service and customer experience.

- Bring finance and IT closer together. This will help with product development and sales.

- Keep yourself informed about development processes within your company and place finance experts in those projects. That way you can have an impact from the get-go.

Finally, no matter what you do, you have to lead the “fear factor.”

Change is frightening. You will meet resistance to change. But you have to know how to lead so that everyone pushes through their fears. Remind everyone that they are not alone and bring everyone together to discuss and plan the future.

What does all of this mean for CFOs?

Generally speaking, CFOs need to take the bull by the horns (so to speak) and start leading the change. You can benchmark some of the companies that are ahead of the AI game, study their learnings and implement what is feasible for your situation.

According to Deloitte, who surveyed companies in the USA, companies that are far in the AI game have three common traits. Deloitte calls these companies forerunners.

Forerunners are able to:

- Make AI an integral part of their strategic plans

These companies see AI as an important tool for their company’s business success . That is why they include an AI implementation plan in their strategies. Most of the companies have a company-wide AI implementation plan, but if the company is not yet ready to embark on that kind of a process, finance can do it on its own and show the rest of the company how it is done.

If you’re just taking your first steps with AI, planning how AI will help with strategic initiatives is a good place to start..

Hint: creating an AI vision and strategy is not a bad idea either. - Focus on revenue and customer opportunities

Forerunners measure and track revenue and customer experience metrics for their AI projects. This is a good way to refocus on what you do. When you measure customer experience, you start to find new ways to use AI for finding business opportunities.

The same forerunners also tracked cost reductions. That makes sense as AI solutions are often used for automating labor-intensive tasks and help to improve productivity. But the point with these forerunners – at least according to Deloitte – is that they did not only focus on cost reductions but also on customer experience and revenue. - Use a different way for acquiring AI

The most common way for companies to start with AI is to use the enterprise software they already have. But forerunners used multiple ways to implement AI solutions. They also used options such as AI-as-a-service and automated machine learning on top of the enterprise solutions. This was a way for them to accelerate the development of AI technologies.

AI is a tool for strategic transformation for financial management

We hope that we have managed to show you some of the ways in which AI technologies can help your finance department work more strategically. Partly it is about developing technologies and partly it is about developing people. Ultimately it is all about planning and leading, nothing more nothing less. AI is not a complicated technology anymore. It does not have to be a massive implementation project. It can be acquired in small steps and one solution at a time.