Blog: How to increase accounts payable automation with your current software capabilities and AI?

Increasing automation in financial administration has been a bit of a struggle for companies. Sure, there are parts of processes and tasks that have been possible to automate. But one area for which there have not been great automation solutions is purchase invoice handling.

Yet, this is usually where companies have a lot to gain in terms of increasing their automation levels. Some purchase invoices can be handled with rules in accounts payable softwares, but rules can only be applied to a fraction of purchase invoices. Something more is needed to get automation levels up. That something is artificial intelligence (AI).

Current state of invoice automation in accounts payable

When people talk about invoice automation, they typically mean purchase order (PO) matching, contract matching, and coding templates. These are the most common ways to use automation in invoice processes.

But there are also other possibilities. Let’s look at an example:

- A company receives 100,000 invoices every year.

- 45 000 of those are PO invoices and 10,000 are contract invoices.

➡️ What about the remaining 45,000 invoices?

They are usually handled manually. Manually post and route one non-PO invoice takes around 10–15 minutes on average and it tends to be a fairly painful process for those involved. That is a lot of working hours to move 45,000 invoices through the process by hand.

At this point our fictional company starts to wonder if they should only use purchase orders?

It is true that there are some big companies who have implemented the so-called “No-PO-No-Pay” policy. They try to get all purchases done through purchase orders, and if there is no PO number on an invoice, the invoice doesn’t get paid.

But making your invoice process work completely through purchase orders and to get it to work 100% correctly is a massive process and there are only a handful of companies that have managed to make it work. That is because there are a lot of challenges in implementing and running it.

If you want to increase your automation levels, there has to be other, better ways to do it.

Rule-based accounts payable automation

One way in which companies try to automate their invoice process is through rules in their accounts payable software. But this is also not without problems. AP automation softwares do not provide sufficient solutions for non-PO invoice automation. Yes, you can automate some of your invoices with rules. But not all and certainly not most. You will still have thousands of non-PO invoices on your lap to process by hand.

We have mapped hundreds of invoice handling processes for hundreds of companies and it is always non-PO invoice handling that has the lowest automation levels, usually between 10% and 25%. Only a very few companies we have met have had non-PO automation levels over 25 %.

This is because building and maintaining those automation rules is very time-consuming and complex work that has to be done by hand. Companies typically have to create hundreds, even thousands of rules for non-PO invoices because there is a lot of variation between them.

Rule-based invoice automation does still have some role in invoice automation, but in order to truly get your automation levels up, you need a better way. This is where AI comes in.

Artificial intelligence in financial administration

AI is the key to getting automation levels up in financial administration generally and in accounts payable specifically. But the buzz that has been surrounding AI in recent years have left financial administrators to wonder if there even are workable solutions.

In fact, the problems AI can solve are pretty ordinary: make the cyclical work more smooth, ease the workload, improve the quality of reporting, decrease mistakes in processes etc. Day-to-day work, not rocket science.

What can financial administration achieve with AI?

Here’s a non-exhaustive list of benefits AI can bring to financial administration processes:

- Better information quality from the processes

- Smaller variations in processes when cyclicity of the process is not affected by how busy people are, sick leaves, or monthly/quarterly/annual rush times

- Better scalability: business can grow without financial administration growing in the same ratio

Improved cost efficiency - Significant learning in financial administration

- Improved preparedness to use AI across the organization

- Better understanding of the processes in financial administration and between financial administration and business.

- Modernized and transparent processes

So there is much to gain. But let’s turn our attention to the accounts payable process next.

What does AI bring to the accounts payable process?

AI is the most effective way to post and route non-PO invoices. It is not complicated or difficult. In fact, it is easy and quick to implement and to use.

What are the steps you can automate in accounts payable?

Generally speaking, quite a lot. Here’s a list of steps that can benefit from automation:

- Manage vendor data

- Receive the invoice

- Capture the data stored in the invoice

- Validate invoice

- Create accounting entry

- Make payments on time

If you can automate even some, if not all, these steps, you are increasing your invoice automation with leaps and bounds.

What are the capabilities of Snowfox.AI in the purchase invoice process?

Yes, we are biased. But let us tell you in 30 seconds what our AI can do:

- Automate coding

- Automate posting

- Automate routing

- Fetch data from invoice files

- Analyze results in real-time

When all those aspects are in place, we move from the status quo of low level automation to automation land.

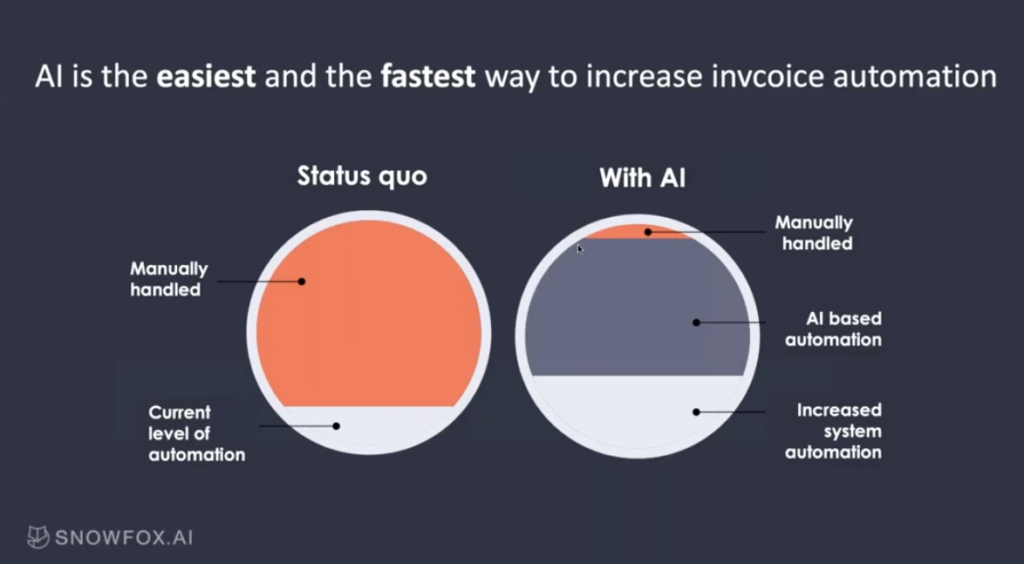

Have a look at this picture:

The status quo describes a typical situation we see when we work with companies. Their non-PO invoice automation level is between 15-25%. On top of that there are a bunch of invoices that need to be manually handled.

With AI you can really increase your purchase invoice automation. Your current AP system can automate the invoices it can, but there will still be a sizable amount of invoices that you are not able to automate. AI is the fastest way to handle those. We have clients whose automation levels have risen from 25% to 90% within two years of implementing AI.

How does invoice automation work with AI?

When you start to utilize AI, you don’t need to create any rules. AI learns from your historic data and creates automation rules from historic invoices and postings.

How?

AI systematically combs through old invoices one by one.

- It searches the invoice data, looks at every single data point on the invoice to understand how it has been processed.

- It looks at the coding to learn how the invoice is coded.

- It makes conclusions about how and why the invoices are posted and coded like they are.

- It builds automation rules automatically based on what it has learned.

- It connects to an AP automation system and starts to automate incoming invoices based on what it has learned and how it has been taught.

- When a new invoice arrives, AI takes the invoice and looks at all the data in it.

- It predicts the coding and routing based on the data in the invoice and based on the historic intelligence. It predicts every dimension: what is the most probable GL account, most probably cost center, VAT, project code, any dimension you are using.

- It does the pre-posting and pre-routing for the invoice and sends it to the review process.

But what if AI makes a mistake?

AI is self-correcting and self-learning!

If AI makes a mistake, it learns from it and adjusts for future invoices. Let’s say a reviewer sees a mistake AI has made on an invoice. For example, AI has predicted the cost center incorrectly. The reviewer corrects the mistake.

Once the invoice has gone through the review and approval process, and the invoice is ready to be booked and paid, the system will send the final posting information back to the AI. AI looks at the final posting information and compares it to how it had predicted it. It then sees there is a change and understands it has made a mistake. It learns and adjusts its rule for the future.

This is how AI will get better and better with every single invoice. All that is needed is data.

How to start utilizing AI in invoice automation?

- If you can, make automation a strategic priority. The consulting firm McKinsey noticed that those companies that have done this have been more successful in their automation projects.

- Even if you can’t get automation to the top of the strategic priorities, don’t let that stop you. Start by identifying the best targets for automation within your own processes. Evaluate the current level of automation you have and research what is technically achievable for each task.

- Through this process you will get a clearer picture of your invoice process. Then you need to understand those processes thoroughly. Look at your processes, look at your data, and calculate how much time is spent on each stage.

- Research different technologies and what they can do. Don’t be afraid to do this even if you feel that your current level of knowledge is not sufficient. It will get better while you research.

- Look for ready made solutions, the world is full of them. AI is no longer a fringe technology.

- Whatever technologies you will end up choosing, make sure you use them systematically. Ad hoc solutions always end up being more of a headache than a solution.

Humans + AI + accounts payable automation softwares = high level of automation

AI does not replace humans. AI needs a teacher and people are the best teachers it can have. The core attribute AI has is that it constantly learns, it never forgets and it is never affected by rush times, stress, bad days, or sick leaves. It plows on no matter what. And once you combine human taught AI with your accounts payable software, you will automatically cover the majority of your purchase invoices and get your automation levels up.

Did we get you interested in the possibilities of AI? Here’s some more reading on the topic if you want to dig a little deeper:

- What are the typical bottlenecks in the purchase invoice process and how to fix them?

- Does your purchase invoice automation system look like a Frankenstein’s monster?

- How to automate financial administration processes: practical advice from finance experts

- How to calculate the costs of handling purchase invoices in financial administration?