Choosing Invoice Automation Software: What You Need to Know

In today’s fast-paced business environment, managing invoices efficiently is critical to maintaining a healthy cash flow and streamlined financial operations. With the increasing volume of invoices and the complexity of manual processing, many businesses are turning to invoice automation software to simplify these tasks. Invoice automation eliminates the need for time-consuming manual data entry, reduces the risk of human error and accelerates workflows, ultimately saving businesses time and money.

By automating invoice processing, companies achieve faster turnaround times, ensure accurate data entry and improve visibility into their accounts payable processes. In a competitive market, investing in the right invoice automation software is essential for improving operational efficiency and enabling businesses to scale seamlessly.

Why Invoice Automation Is Essential

Manually processing invoices often comes with significant challenges that can hinder business efficiency. One of the most prominent issues is the risk of human error. With manual data entry, mistakes such as incorrect amounts, missed approvals and duplicate payments can occur, leading to financial discrepancies which can strain vendor relationships. As invoices must be manually reviewed and approved, delays are another common challenge, often causing slow payments and disrupted cash flow. The reliance on paper invoices and manual tasks also increases operational costs, requiring substantial resources to manage invoices.

Automating the invoicing process offers numerous benefits. Automation drastically speeds up invoice processing by removing the need for manual intervention in data entry, validation and approval. This not only accelerates the overall process but also ensures accuracy, minimising the risk of errors. Additionally, automation reduces operational costs by streamlining tasks and reducing the need for additional human resources. This enables businesses to focus on more strategic tasks, contributing to long-term efficiency and profitability.

Key Features to Look for in Invoice Automation Software

When choosing invoice automation software, there are several key features that can significantly impact its effectiveness and suitability for your business. Here are the key features to look for:

Ease of Integration

One of the most important considerations when adopting invoice automation software is its ability to integrate seamlessly with your existing accounting or ERP systems. Software that easily connects with your current system reduces the time spent on manual data entry and eliminates the need for costly system overhauls.

Data Security & Compliance

Ensuring financial data security is always a top priority. The best invoice automation software will comply with relevant regulatory standards (such as GDPR) and offer features such as encryption, secure payment gateways and access controls. This ensures that sensitive data is protected from breaches and that the software helps businesses meet legal requirements.

Customisable Workflow

Every business has unique processes when it comes to handling invoices. Therefore, the ability to customize invoice workflows is a critical feature. Invoice automation software allows businesses to tailor approval processes to fit their specific needs, whether it’s setting up multi-step approvals, routing invoices to appropriate departments or establishing specific rules for exceptions.

Multi-currency & Multi-language Support

For businesses operating internationally, having software that supports multiple currencies and languages is essential. This ensures that invoice processing is streamlined across various regions, regardless of the local financial regulations or language differences.

Reporting & Analytics

The ability to access real-time insights into invoice statuses and AP performance is one of the most significant advantages of using automation software. Reporting and analytics tools allow businesses to track the progress of invoices, identify bottlenecks, and provide an overview of outstanding payments. These insights help businesses manage cash flow more effectively and ensure that invoices are processed on time, reducing the risk of late payments or missed deadlines. With advanced reporting, businesses can make data-driven decisions that contribute to improved financial health.

Considerations Before Choosing Invoice Automation Software

It’s important to carefully assess several factors when selecting the right invoice automation software, to ensure that the solution aligns with your business operations and goals. Here are some key considerations:

Scalability

Choose invoice automation software that can scale alongside your business. As your company grows, so will your invoice volumes and processing complexity. The software should be able to handle increased workloads and additional users without compromising performance.

Ease of Use

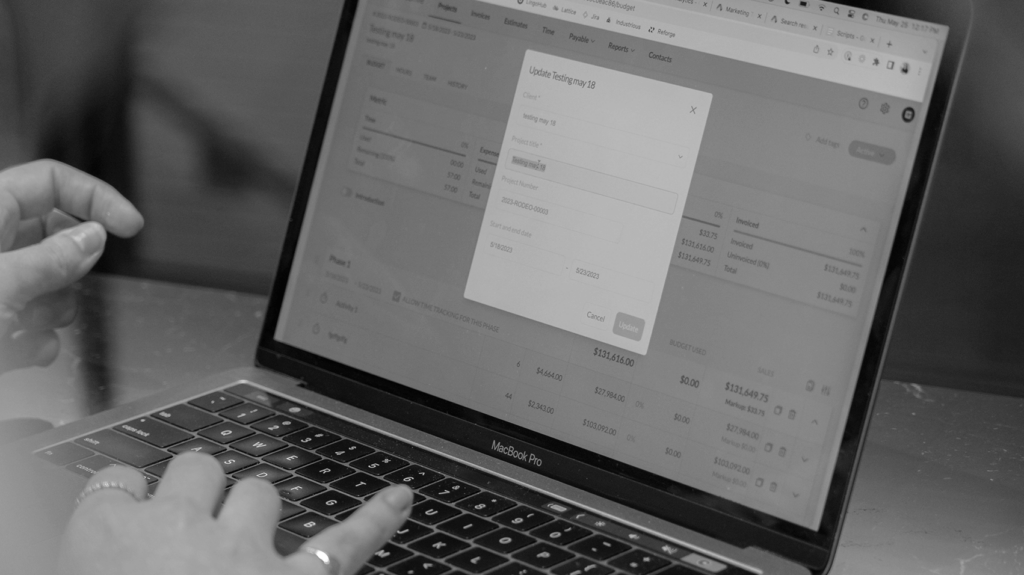

A user-friendly interface is essential for smooth adoption across your team. Invoice automation software should be intuitive, with clear navigation and simple workflows. The easier the system is to use, the faster your team will adapt to it, reducing the learning curve and ensuring productivity.

Customer Support & Training

Having good customer support on hand is essential when using software that impacts financial processes. Ensure that the software provider offers reliable support channels and timely assistance. Also, training resources such as webinars, documents and tutorials will empower your team to use the software effectively.

Cost

While initial costs should be considered, it’s equally important to consider the long-term savings that invoice automation can provide. Evaluate the software’s pricing structure, including any hidden fees for updates or maintenance. In many cases, the efficiencies gained from automating manual processes can offset upfront costs by reducing operational expenses in the long run.

Top Invoice Automation Software Options

| Software | Key Features | Pros | Cons |

| Snowfox | AI-powered automation, Real-time analytics, Seamless ERP integration, Automated workflows | Scalable, Customisable workflows, Excellent customer support, Accurate AI predictions, Seamless ERP integration, Real-time data analytics | Newer to the market compared to some competitors, May require initial adjustment time |

| SAP Concur | Invoice Management, Spend Control | Robust enterprise features, Travel and expense integration, Suitable for large corporations | Expensive for small to mid-sized businesses, complex setup and configuration, requires significant resources for implementation |

| Tipalti | End-to-end AP automation, Global payment capabilities | Good for global operations, Strong compliance features, Scalable for international businesses | High pricing, Complex setup, May not suit smaller businesses or those with simpler needs |

| FreshBooks | Simple invoicing, Time tracking | User-friendly, Ideal for freelancers and small businesses | Limited scalability, Lacks advanced features for large organisations, May not integrate well with complex accounting systems |

How to Implement Invoice Automation Successfully

Implementing invoice automation software can significantly improve your accounts payable processes, but the transition must be handled carefully to ensure success. Here’s our step-by-step guide to help you get started:

- Assess Your Current Invoice Processing System

Evaluate your current workflows to identify inefficiencies, such as delays or errors. This helps pinpoint where automation can bring the most value. - Define Your Goals

Set clear objectives, such as reducing manual entry or speeding up invoice payments. Having clear goals ensures you select the right automation software. - Choose the Right Software

Carefully evaluate invoice automation software options based on features, scalability and ease of integration. Ensure the solution aligns with your current and future business needs. - Plan for Integration

Plan training and resources in advance to ensure the automation solution integrates smoothly with your existing accounting systems. This prevents disruption and allows for efficient implementation. - Train Your Team

Provide comprehensive training to staff, focusing on key software features. Ongoing support should also be available to help with learning or any issues. - Start with a Pilot Phase

Begin with a small-scale implementation to test the software’s effectiveness. This allows for adjustments to be made before full-scale deployment. - Transition Gradually

Once the pilot phase is successful, roll out automation across your accounts payable department. Monitor progress and adjust as needed before full adoption. - Continuously Optimise and Refine

Regularly assess system performance and gather user feedback. Continuously refine workflows to ensure the solution remains efficient and effective.

Real-world Case Studies

Adopting invoice automation has led to significant improvements in many businesses across the globe. Here are two examples of companies that successfully implemented automation and the results they achieved:

Case Study A – A Retailer

Case Study A, a mid-sized retailer, adopted invoice automation to streamline its accounts payable process. By automating data capture and approval workflows, they reduced invoice processing time by 60%. This saved the company substantial time and reduced errors caused by manual data entry, ultimately leading to faster payments and stronger supplier relationships.

Case Study B – A Global Manufacturing Firm

Company B, a global manufacturing firm, implemented invoice automation to handle their high volume of invoices. With automated approval routing and AI-driven validation, the company achieved 95% accuracy in invoice processing and reduced costs by 40%. Streamlined workflows enabled the accounts payable team to focus on higher-value tasks.

Common Pitfalls to Avoid

While invoice automation can greatly improve efficiency, businesses sometimes face challenges during selection and implementation. Here are some common mistakes and tips for avoiding them:

Not Defining Clear Goals

Failing to outline clear objectives can lead to underutilisation of automation software. Before implementing, ensure you know exactly what you want to achieve; whether it’s reducing processing time or improving accuracy.

Inadequate Integration with Existing Systems

Choosing software that doesn’t integrate well with your current accounting or ERP system can lead to delays and inefficiencies. Select an automation solution that offers seamless integration with your existing systems to avoid these issues.

Overlooking User Training

Skipping comprehensive training for your team can hinder the success of the automation process. Ensure that your staff are adequately trained and comfortable using the new system to maximise its benefits.

Neglecting Data Security and Compliance

Not prioritising security and compliance can expose your company to regulatory breaches. Opt for software with robust security features and compliance tools to safeguard sensitive financial data.

Underestimating the Need for Scalability

Choosing software that doesn’t grow with your business can limit long-term success. Choose a solution that is scalable and can handle increasing invoice volumes as your business expands.

Maximising Efficiency with Invoice Automation

Invoice automation brings significant benefits to businesses, including improved efficiency, reduced errors and significant cost savings. By automating manual tasks such as data entry and invoice approval, companies can streamline operations, save valuable time and focus on more strategic activities.

When selecting the right invoice automation software, it’s important to consider your business’s specific needs – both now and in the future. Look for features that align with your goals, whether it’s scalability, ease of use or seamless integration with existing finance systems. The right invoice automation solution will help a business operate more efficiently and stay competitive in today’s fast-paced business environment.