How Automation Can Enhance Your Invoice Processing Efficiency

In today’s fast-paced business environment, efficiency is key, especially when it comes to managing invoices. Automated invoice processing leverages advanced technology to handle the time-consuming tasks involved in manually managing invoices. By using AI-powered automation to capture, categorise, and approve invoices, businesses can significantly reduce the costs involved with the manual labour required. Automation also helps minimise errors, ensuring that invoices are rapidly processed with accuracy. Discover how invoicing processing automation can streamline business operations, save valuable time and reduce the risk of costly mistakes, all while improving overall efficiency in your accounts department.

Benefits of Automation in Invoice Processing

Time Savings

Automated invoice processing speeds up the entire invoicing cycle by quickly capturing, approving and processing invoices. This allows finance teams to focus on more strategic tasks, reducing the time spent on monotonous work.

Error Reduction

By utilising intelligent data entry, matching and approval systems, automated invoicing significantly reduces the possibility of human error. This ensures invoices are processed accurately, avoiding costly mistakes and disputes with vendors.

Cost Reduction

Automation cuts down administrative costs by reducing manual intervention and paper-based processes. With fewer errors and late fees, businesses can streamline their operations and optimise their budget allocation.

Improved Compliance

Automated invoice processing helps businesses maintain consistent workflows, ensuring all invoices follow the same process every time. This also generates clear audit trails, improving transparency and making it easier to meet compliance standards.

How Automation Works in Invoice Processing

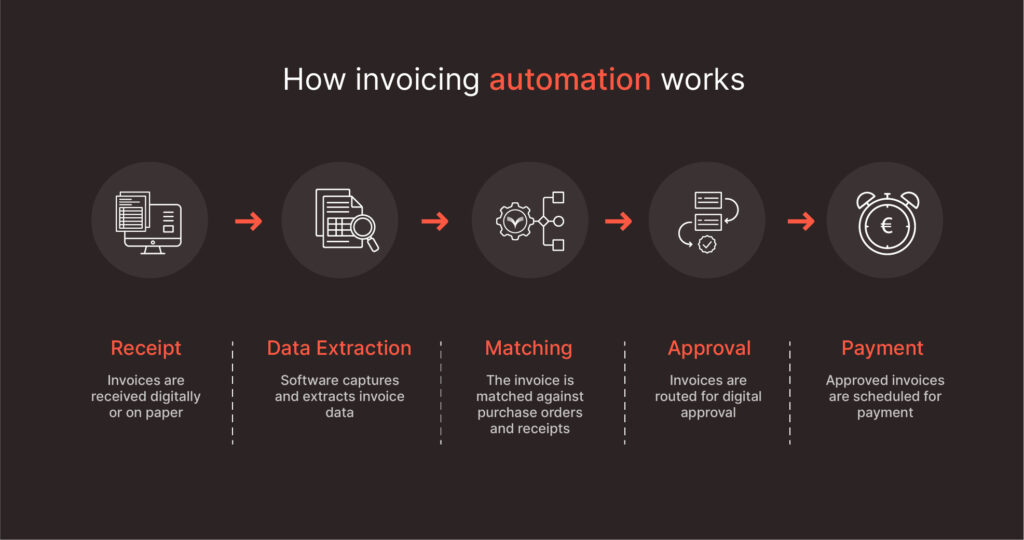

Automated invoice processing works by streamlining the entire workflow, from receipt all the way to payment. The visual below shows the process step by step:

Integration with existing ERP or accounting software ensures that the automated process aligns perfectly with your current systems, eliminating manual data entry and enabling smooth, efficient payments. This end-to-end automation reduces human error, speeds up the approval process and ensures timely payments, improving both operational efficiency and accuracy.

Real-Time Tracking and Visibility

Automation provides businesses with real-time tracking of invoices, payments and approvals, offering complete visibility throughout the accounts payable process. This instant access enables finance teams to effortlessly track outstanding invoices and payments, promoting better cash flow management. With real-time data at their fingertips, businesses can make more informed financial decisions to optimise cash flow, avoid late fees and encourage stronger vendor relationships.

Common Challenges and Considerations

When implementing automated invoice processing, businesses often have concerns relating to system integration, upfront costs and the need for thorough employee training. Integrating their automation software with existing ERP or accounting systems can pose technical challenges, especially if the systems are outdated or incompatible. Upfront costs can also be a barrier, as businesses need to balance the initial investment with long-term savings. Additionally, ensuring employees are properly trained to use the new system is crucial for maximising its potential.

To overcome these challenges, companies should prioritise selecting a solution that integrates seamlessly with their existing accounting system, invest in training and to build confidence in the system, and carefully assess the ROI to justify the initial cost.

Case Study

Lumon, an international group specialising in balcony facades and terrace products, achieved efficiency improvements in its purchase-to-pay process after implementing Snowfox AI. By automating invoice processing, Lumon drastically reduced manual labour, with AI now handling the majority of invoices that were previously managed manually. As a result, Lumon’s accounts payable team was able to process an increased volume of invoices without the need to expand resources. As Hanna Van Enk, Chief Financial Officer for Lumon states, “We cannot imagine working without it in the future.”

By streamlining invoice processing and reducing manual tasks, automation significantly enhances overall efficiency. It enables businesses to minimise errors, optimise cash flow and make data-driven decisions with ease. Embracing invoice automation allows companies to scale effectively, managing growing volumes without the need for additional resources. Automation not only improves day-to-day operations but also positions businesses for long-term growth and success, driving both cost savings and operational improvements.